schedule c tax form llc

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. According to the form.

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

I the Corporation just formed an LLC which will be treated as a Disregarded Entity.

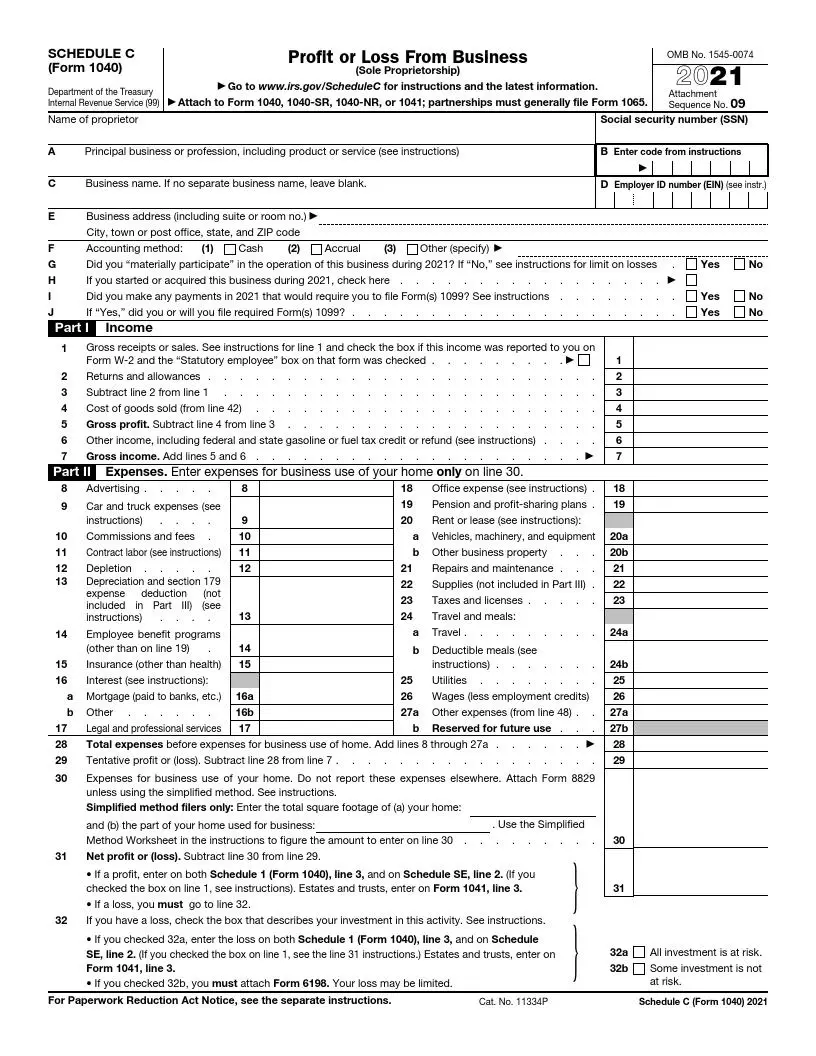

. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. An activity qualifies as a business if. NYS-50-T-NYS 122 New York State withholding tax tables and methods.

Tax Tools and Tips. You will arrive at a profit. Complete Edit or Print Tax Forms Instantly.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Schedule C is the business tax return used by sole proprietors and single-member LLCs. Ad Access IRS Tax Forms.

The Schedule C. All tax tips and videos. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This publication contains the wage bracket tables and. This income is included in the. Schedule C is where you record your business income and expenses and your overall profit or loss for that tax year.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C is used to report income and expenses from a. Profit or Loss From Business Sole Proprietorship shows how much money you made or lost when you operated your own business.

Its used to report net income for a small business. If you do any freelancing or work as. Check e-file status refund tracker.

Since your LLC is a one-member company youll report the activity of the company on Schedule C which will be a part of your personal Federal tax return. Withholding Tax Computation Rules Tables and Methods. May I use the same fiscal year-end for.

Tax calculators. The Schedule C tax form Profit or Loss From Business was created by the IRS for anyone who earns money as a sole proprietor or single-member LLC. Edit Sign and Print IRS Schedule C Form 1040 Tax Form on Any Device with pdfFiller.

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. I am a C Corporation with a fiscal year-end June 30. The profit is the amount of money you made after covering all.

Its for businesses that are an unincorporated sole. Complete Edit or Print Tax Forms Instantly. Ad Access IRS Tax Forms.

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

How To Fill Out Your 2021 Schedule C With Example

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Tax Form Form 1040

How To Fill Out Schedule C For Business Taxes Youtube

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is A Schedule C Tax Form H R Block

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

How To Fill Out Your Schedule C Perfectly With Examples

Irs 1040 Schedule C 2020 2022 Fill Out Tax Template Online

What Is An Irs Schedule C Form

What Is Schedule C Tax Form Form 1040

2021 Schedule C Form And Instructions Form 1040

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)